UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 27, 2022

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||

(Address of principal executive offices) (Zip Code)

(800 ) 878-8889

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||||||

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||||||

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||||||

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of exchange on which registered | ||||||

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On July 27, 2022, Tempur Sealy International, Inc. released an updated investor presentation (the "Investor Presentation"). The Investor Presentation will be used from time to time in meetings with investors. A copy of the Investor Presentation is furnished herewith as Exhibit 99.1 and is incorporated into this Item 7.01 by reference.

The information disclosed pursuant to this Item 7.01 (including Exhibit 99.1) shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise subject to the liability of that section and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number | Description | |||||||

| 99.1 | ||||||||

| 104 | Cover page interactive data file (embedded within the Inline XBRL document). | |||||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 27, 2022

| Tempur Sealy International, Inc. | ||||||||

| By: | /s/ Bhaskar Rao | |||||||

| Name: | Bhaskar Rao | |||||||

| Title: | Executive Vice President & Chief Financial Officer | |||||||

© 2022 Tempur Sealy International, Inc. All rights reserved. We continue to demonstrate the resilience of our business model as we generate profits, invest in our business, return capital to shareholders, and outperform the market. The team remains focused on delivering on our initiatives to drive continued success. TEMPUR SEALY INTERNATIONAL, INC., TPX “ “

To Improve the Sleep of More People, Every Night, All Around the World Who We Are Tempur Sealy is committed to improving the sleep of more people, every night, all around the world. As a leading designer, manufacturer, distributor and retailer of bedding products worldwide, we know how crucial a good night of sleep is to overall health and wellness. Utilizing over a century of knowledge and industry‐leading innovation, we deliver award‐winning products that provide breakthrough sleep solutions to consumers in over 100 countries. Our highly recognized brands include Tempur‐Pedic®, Sealy® and Stearns & Foster® and our popular non‐branded offerings consist of value‐focused private label and OEM products. At Tempur Sealy we understand the importance of meeting our customers wherever and however they want to shop and have developed a strong omni‐channel retail strategy. Our products allow for complementary merchandising strategies and are sold through third‐party retailers, our 650+ Company‐owned stores worldwide and our e‐commerce channels. With the range of our offerings and variety of purchasing options, we are dedicated to continuing to turn our mission to improve the sleep of more people, every night, all around the world into a reality. Importantly, we are committed to carrying out our global responsibility to protect the environment and the communities in which we operate. As part of that commitment, we have established the goal of achieving carbon neutrality for our global wholly owned operations by 2040. Global Bedding Industry1 P U R P O S E Estimated global bedding market includes mattresses, foundations, pillows and other bedding products 2 North America TPX Share TPX Share International Retail Value $120 Billion Estimated Tempur Sealy Share

Industry • The global bedding industry of ~$120 billion1 has historically experienced consistent growth. • The U.S. market averages mid‐ single digit growth annually, driven by units and dollars.1 • The international market is highly fragmented and about 40% larger than the size of the U.S. market.1 Consumer • Consumers continue to make the connection between a good night’s sleep and health & wellness. • Enhanced focus on health over the past year has strengthened the health & wellness trend. • Consumer confidence, consumer spending and the housing market correlate to the bedding industry. Tempur Sealy • Global omni‐channel distribution strategy to be where the consumer wants to shop. • Track record of developing and marketing differentiated products through consumer‐centric innovation for the total global bedding market. • Robust free cash flow2 and fortified balance sheet that provide flexibility to take advantage of industry and market opportunities and return capital to shareholders. TPX at a Glance 3

• Worldwide omni‐channel presence • Iconic brand and product portfolio • World‐class manufacturing capabilities • Industry‐leading balance sheet and free cash flow2 Adjusted earnings per share2 is expected to grow at a CAGR of 27% between 2017-2022 Competitive Advantages 4 *2022 adjusted EPS based on the midpoint of Tempur Sealy's full year guidance $0.82 $0.74 $1.00 $1.94 $3.19 $2.70 $‐ $1.00 $2.00 $3.00 $4.00 2017 2018 2019 2020 2021 *2022 Full Year Adjusted EPS2

Product Brands Mattresses / Pillows / Accessories Product and Retail Brands DTC Retailer Brands Online / Offline 5

Increase total addressable market internationally through new product launches in Europe & APAC. Expand into OEM market to drive further sales growth. Grow wholesale through existing and new retail relationships. Invest in innovation to meet customer demand. Execute on capital allocation strategy. Expand direct‐to‐consumer through ecommerce and company‐owned stores. Building Blocks to Future Growth 6 Invest in Stearns & Foster product and marketing to more than double the brand’s global sales.

Worldwide Omni-Channel 7

• Significant worldwide sales growth • Highly profitable and expanding rapidly • Direct customer relationships Ecommerce • Luxury Tempur‐Pedic®, Dreams, and multi‐branded showroom experiences • Operate over 650 stores worldwide and expanding • Own the end customer and highly profitable Company- Owned Stores • Third‐party retailers are our largest distribution channel • Significant private label opportunity • Valued supplier, win‐win relationships Wholesale Successful Omni-Distribution Platform 8

Third-Party Retailers • Win‐win relationships • Broad‐based worldwide distribution and broadly diversified • Over 5,400 retail partners around the world selling through over 25,000 doors and ecommerce platforms • Global sales force of over 500 people supporting our portfolio of brands U.S. OEM Opportunity • OEM is about 20% of the U.S. mattress market and growing,1 supported by recent U.S. anti‐dumping actions • Leverages manufacturing expertise, diversifies consolidated sales stream, and extends manufacturing profits beyond our own brands • Plans to invest an incremental $200 million by 2023 to increase U.S. pouring capacity for TEMPUR® material and specialty and conventional foams by approximately 50% • Targeting $600 million of annual sales by 2025 Wholesale 9

• Strong, long‐term growth of high‐margin sales from web, call center, and company‐owned stores • Strong growth within the direct channel, growing 66% in Q2’22, primarily driven by the acquisition of Dreams in the UK • Less than one‐third of our direct channel sales utilize financing. We believe our high quality of financing and low‐ utilization rate minimize the business’s exposure to modest changes in retail financing interest rates. Direct to Consumer 10 $‐ $50 $100 $150 $200 $250 $300 $350 Q2 2018 Q2 2019 Q2 2020 Q2 2021 Q2 2022 Global Direct Sales Intl NA 9% 13% 15% 14% 22% 5% 10% 15% 20% 25% 30% Q2 2018 Q2 2019 Q2 2020 Q2 2021 Q2 2022 Direct Channel Sales as a Percentage of Total Sales

TEMPUR® EuropeSealy® Gallery Asia SOVA® SwedenSleep Outfitters® U.S. Tempur‐Pedic® U.S. Tempur‐Pedic® MexicoDreams UK We see a potential opportunity to organically increase our store count through opening an average of 60 new stores per year. Company-Owned Store Strategy O P E R A T I N G O V E R 6 5 0 R E T A I L S T O R E S G L O B A L L Y 11

Brands & Products 12

• The bedding market has historically experienced consistent growth. While our share has grown significantly over the last 5 years, the total market share of the largest three domestic bedding manufacturers has not materially changed.1 • Branded bedding represents the majority of products sold, especially in premium price points. • Sealy® and Tempur‐Pedic® represent the #1 and #2 bestselling mattress brands in 2020.3 North America Markets 13

• Highly fragmented with broad geographic diversity across Europe and Asia • Acquired Dreams, the leading bedding retailer in the UK in 2021 • Developing new TEMPUR® line of mattresses to expand addressable market in 2023 • Tempur Sealy customizes go‐to market approach by country • Europe: success with high‐quality products, targeting growth through distribution, and new Sealy®‐UK joint venture and Dreams acquisition • Asia: opportunity in emerging market and targeting aggressive addressable market expansion through distribution and organic market growth International Markets 14

Rapidly Growing International Joint Ventures • Founded in 2000 • Operates in 21 countries and territories • Top 3 internationally branded bedding manufacturer in China • Full-time employees: 1,100+ Asia • Acquired in 2020 • Full-time employees: 250+ United Kingdom $340 MILLION OF JOINT VENTURE SALES IN 2021 5-YEAR GROWTH CAGR: 17% 15

Expanding Global Licensing Sales Sealy Manufacturing Licensees: • Our 27 licensee manufacturing facilities generate high return on investment • They represent a low-risk opportunity to introduce our brands and products in regions in which we do not currently operate, primarily across EMEA, APAC, and Latin America Brand Extension Licensees: • We license our Tempur-Pedic, Sealy and Stearns & Foster brands across North America, Europe and Asia, to drive incremental profits and expand brand awareness • Licensed products are complementary to our core operations and include sleep-adjacent categories such as bedding, pajamas, and pet sleep 16 Significantly increases global brand awareness and drives incremental profits

Tempur-Pedic®: leading worldwide premium bedding industry position • Tempur‐Pedic® uniquely adapts, supports, and aligns to you to deliver truly life‐changing sleep. $2,449‐$7,999 Stearns & Foster®: high-end-targeted brand • The world’s finest beds that are made with exceptional materials, time‐honored craftsmanship, and unparalleled design. $1,949‐$4,449 Sealy®: #1 bedding brand in the U.S.3 • Combines innovation, engineering, and industry‐leading testing to ensure quality and durability. $229‐$3,499 Private Label Offerings: customized product • Offers products for the value‐oriented consumer. Portfolio of Global Brands 17

Natural Comfort Snoring Support Climate Sleep-Health Metrics Innovative Technologies S O L U T I O N - D R I V E N I N N O V A T I O N F O R T O D A Y ’ S C O N S U M E R 18

• Expect to launch an entirely new product lineup for TEMPUR® in both the Europe and Asia‐Pacific markets beginning in the first quarter of 2023. • The underlying technology of the new lineup builds on the innovation that has already been very well received in North America. • This new lineup will also broaden the price range of our international offerings to appeal to a broader consumer base. • We expect these new products and the broadened price points to expand our total international addressable market and help us strengthen our presence in regions where our brands are currently underpenetrated.1 International 2023 TEMPUR® Launch 19

Leading research and development process to deliver meaningful innovation that meets consumer needs Surface‐Guard Technology™ SealyChill™ Featuring Industry- Leading Technologies U.S. Product Launch Cycle POSTUREPEDIC ® PLUS POSTUREPEDIC® ESSENTIALS™ Launched in 2021 Launching in 2022 20

21 Stearns & Foster Opportunity Product Investments • Launching new, innovative Stearns & Foster products in 4Q’22 Marketing Investments • Supporting Stearns & Foster with record advertising in 2022 Opportunity to grow Stearns & Foster to be our next $1 BILLION BRAND, more than doubling its size today Channel Investments • Expanding Stearns & Foster presence through new e‐commerce platform launched in 2Q’22

World-Class Manufacturing Capabilities 22

Leading Manufacturing Capabilities • 69 manufacturing facilities • 16 million square feet of manufacturing & distribution operations R&D Innovation • 75,000 square feet of research & development • 4 state‐of‐the art product‐testing locations Wholly owned (30) Joint Venture (8) Licensee (27)Tempur‐Pedic® Facility (4) World-Class Manufacturing Capabilities 31 NORTH AMERICAN FACILITIES | 38 INTERNATIONAL FACILITIES Albuquerque, NM 23

Non-Recurring Investments • Opening a new, state‐of‐the‐art Tempur‐Pedic® and OEM foam‐ pouring facility in Indiana by 2023 • Expanding three existing foam facilities in the U.S. by 2023 • Increasing capacity to hold key chemical inputs and expand safety stock of certain products • Expanding our total warehouse footprint Expanding Manufacturing Capacity 24 • Our investments to expand our U.S. manufacturing capacity this year are laying the groundwork for our next stage of long-term growth • We expect capex spend will moderate in 2023 as we complete our growth initiatives, and further normalize in future periods $‐ $50 $100 $150 $200 $250 $300 2022 Normalized Spend Projected Capex Investments(1) Growth Maintenance

Recent Performance 25

Three Months Ended Trailing Twelve Months Ended (in millions, except percentages and per common share amounts) June 30, 2022* June 30, 2021 % Change June 30, 2022* June 30, 2021 % Change Net Sales $1,211.0 $1,169.1 3.6% $5,168.4 $4,402.2 17.4% Net Income $90.6 $140.8 ‐35.7% $574.5 $537.4 6.9% Adjusted Net Income2 $103.2 $161.5 ‐36.1% $589.5 $594.7 ‐0.9% EPS $0.51 $0.69 ‐26.1% $2.95 $2.55 15.7% Adjusted EPS2 $0.58 $0.79 ‐26.6% $3.03 $2.84 6.7% Second Quarter and Trailing Twelve Month Performance 26 Q2’22 Sales by Channel 22% 78% Direct Wholesale

Expect full-year adjusted EPS between $2.60 and $2.80 2022 Other Modeling Assumptions Depreciation & Amortization $185M Capital Expenditures >$250M Interest Expense $100M U.S. Federal Tax Rate 24.5% Diluted Share Count 180M shares 2022 Outlook1 27 Our 2022 expectations include investments of: • Approximately $30 million in expense related to new product launches • Operational investments to service our customers • Record advertising investments • Repurchasing at least 10% of our shares outstanding *2022 EPS based on the midpoint of Tempur Sealy's full year guidance $‐ $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 2020 2021 E2022* Projected 2‐Year Adjusted EPS(2) Growth of >40%

Historical Industry Performance Source: ISPA Reports, includes domestic manufactured units 2001 – 2021, import units 2016‐2021 • Industry unit growth is generally consistent over a cycle, growing low‐ single digits in the average year, growing at a 2% CAGR from 2001‐2021 • Industry is typically resilient to economic recessions and recovers quickly after macroeconomic disruptions 2005 – 2009 CAGR of -7% 2009 – 2021 CAGR of +5% 28 ‐ 5,000 10,000 15,000 20,000 25,000 30,000 35,000 Domestic Mattress Unit Sales

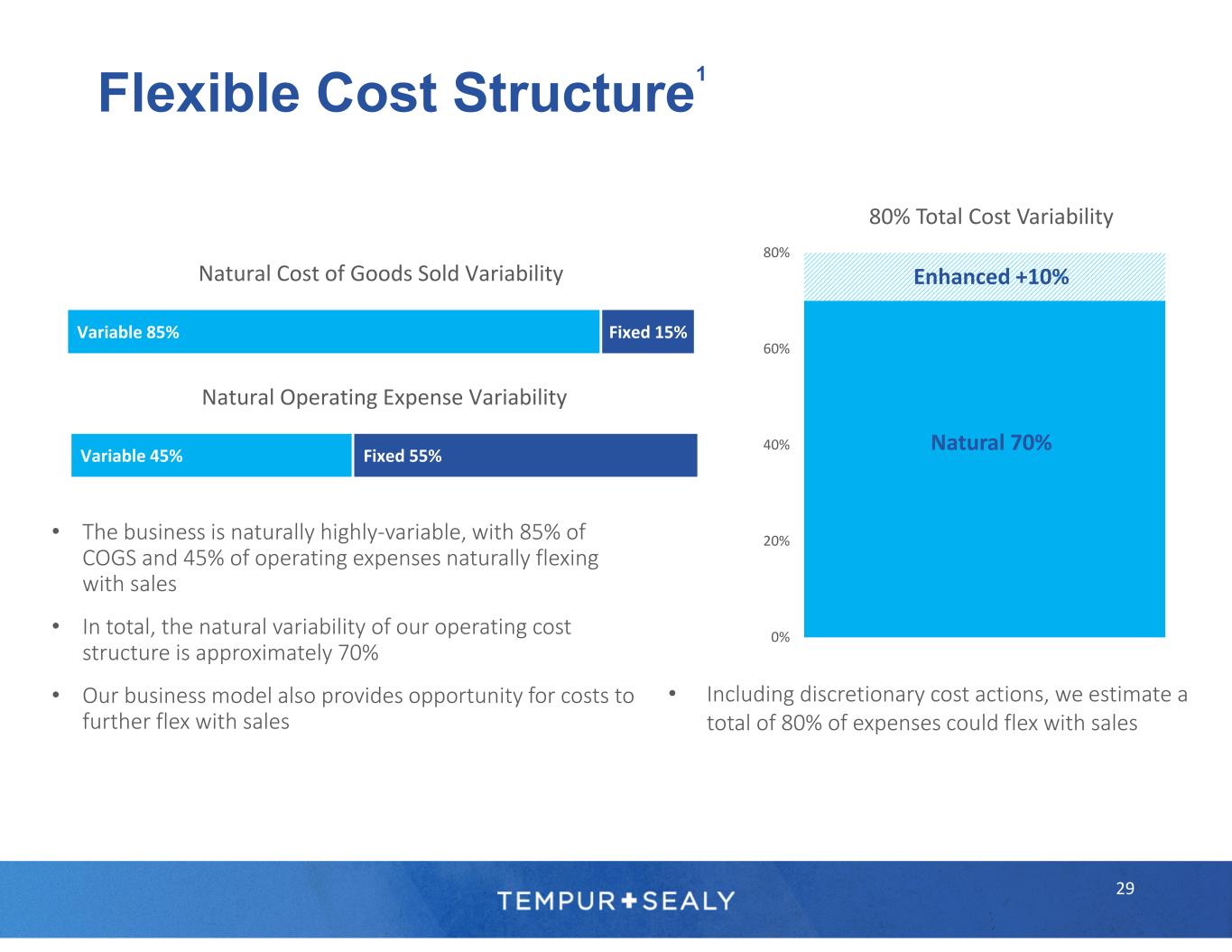

0% 20% 40% 60% 80% Enhanced +10% Natural 70% Flexible Cost Structure1 29 • The business is naturally highly‐variable, with 85% of COGS and 45% of operating expenses naturally flexing with sales • In total, the natural variability of our operating cost structure is approximately 70% • Our business model also provides opportunity for costs to further flex with sales Variable 85% Fixed 15% Natural Cost of Goods Sold Variability Variable 45% Fixed 55% Natural Operating Expense Variability 80% Total Cost Variability • Including discretionary cost actions, we estimate a total of 80% of expenses could flex with sales

Industry-Leading Balance Sheet & Cash Flow 30

31 • Long‐term target leverage ratio of 2.0 – 3.0x2 • Continue to invest in the business, including a new domestic foam‐pouring plant to be operational in 2023 • Disciplined approach to shareholder returns includes a quarterly dividend and expected repurchase of at least 10% of our shares outstanding in 2022 • Maintain capacity for strategic acquisitions Balanced Capital Allocation Strategy 31 $‐ $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 2019 2020 2021 TTM Q2 2022 Capital Allocation Capex Share Repurchases Dividend Acquisitions

$0 $200 $400 $600 $800 2018 2019 2020 2021 TTM 2022 Full-Year Operating Cash Flow Credit ratings: Fitch: BB+ (August 2021) Moody’s: Ba1 (September 2021) S&P: BB+ (September 2021) Strong Balance Sheet & Cash Flow 32 1.00x 1.50x 2.00x 2.50x 3.00x 2Q21 3Q21 4Q21 1Q22 2Q22 Leverage2 Target Range Leverage $0 $200 $400 $600 $800 $1,000 $1,200 2018 2019 2020 2021 TTM 2022 Full-Year Adjusted EBITDA2

Environmental, Social, & Corporate Governance 33

Environmental, Social, & Governance Tempur Sealy is committed to protecting and improving our communities and environment. 34

Environmental • Committed to achieving carbon neutrality for our wholly owned global operations by 2040 • Achieved an 8.4% reduction in greenhouse gas emissions per unit produced at our wholly owned manufacturing and logistics operations in 2021 • Improved the percentage of waste diverted from our North American wholly‐owned manufacturing operations to 94% in 2021, compared to 91% in 2020, furthering our progress towards our goal of achieving zero landfill waste by the end of 2022 • Completed the installation of solar panel technology at our largest manufacturing facility in Albuquerque, New Mexico in 2021 Social • Embedded ESG performance as a metric in executive leadership’s compensation for 2021 • In 2022, we launched a Sealy®‐branded eco‐friendly mattress collection made with responsibly sourced materials • Contributed over $100 million in product, stock, and cash to charity organizations since 2010 • Pledged $2 million to support a pediatric sleep center • Contributed monetary aid to support Ukrainian children and families and supplied over 1,100 bedding products to refugee centers Corporate Governance • Established Nominating Corporate Governance Committee oversight of our practices and positions relating to ESG issues • Increased the number of women represented on our Board of Directors to 3 directors, representing 33% of the Board Environmental, Social, & Governance Tempur Sealy is committed to protecting and improving our communities and environment. 35

Thank You for Your Interest in Tempur Sealy International For more information, please email: investor.relations@tempursealy.com 36

Appendix 37

This investor presentation contains statements relating to the Company’s quarterly cash dividend, the Company’s share repurchase targets, the Company’s expectations regarding net sales for 2022 and adjusted EPS for 2022 and subsequent periods and the Company’s expectations for increasing sales growth, product launches, channel growth, acquisitions and commodities outlook, and expectations regarding supply chain disruptions, the macroeconomic environment and COVID‐related disruptions. Any forward‐looking statements contained herein are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations, meet its guidance, or that these beliefs will prove correct. Numerous factors, many of which are beyond the Company’s control, could cause actual results to differ materially from any that may be expressed herein as forward‐looking statements. These potential risks include the factors discussed in the Company’s Annual Report on Form 10‐K for the year ended December 31, 2021 and in the Company's Quarterly Report on Form 10‐Q for the quarter ended March 31, 2022. There may be other factors that may cause the Company’s actual results to differ materially from the forward‐looking statements. The Company undertakes no obligation to update any forward‐looking statement to reflect events or circumstances after the date on which such statement is made. Note Regarding Historical Financial Information: In this investor presentation we provide or refer to certain historical information for the Company. For a more detailed discussion of the Company’s financial performance, please refer to the Company’s SEC filings. Note Regarding Trademarks, Trade Names, and Service Marks: TEMPUR®, Tempur‐Pedic®, the Tempur‐Pedic & Reclining Figure Design®, TEMPUR‐Adapt®, TEMPUR‐ProAdapt®, TEMPUR‐LuxeAdapt®, TEMPUR‐PRObreeze°™, TEMPUR‐LUXEbreeze°™, TEMPUR‐Cloud®, TEMPUR‐Contour™, TEMPUR‐Rhapsody™, TEMPUR‐Flex®, THE GRANDBED BY Tempur‐Pedic®, TEMPUR‐Ergo®, TEMPUR‐UP™, TEMPUR‐Neck™, TEMPUR‐Symphony™, TEMPUR‐Comfort™, TEMPUR‐Traditional™, TEMPUR‐Home™, Sealy®, Sealy Posturepedic®, Stearns & Foster®, COCOON by Sealy™, SealyChill™, and Clean Shop Promise® are trademarks, trade names, or service marks of Tempur Sealy International, Inc., and/or its subsidiaries. All other trademarks, trade names, and service marks in this presentation are the property of the respective owners. Limitations on Guidance: The guidance included herein is from the Company’s press release and related earnings call on July 27, 2022. The Company is neither reconfirming this guidance as of the date of this investor presentation nor assuming any obligation to update or revise such guidance. See above. Forward-Looking Statements 38

In this investor presentation and certain of its press releases and SEC filings, the Company provides information regarding adjusted net income, adjusted EPS, EBITDA, adjusted EBITDA, free cash flow, consolidated indebtedness less netted cash, and leverage, which are not recognized terms under U.S. Generally Accepted Accounting Principles (“GAAP”) and do not purport to be alternatives to net income and earnings per share as a measure of operating performance, an alternative to cash provided by operating activities as a measure of liquidity, or an alternative to total debt. The Company believes these non‐GAAP measures provide investors with performance measures that better reflect the Company’s underlying operations and trends, including trends in changes in margin and operating expenses, providing a perspective not immediately apparent from net income and operating income. The adjustments management makes to derive the non‐GAAP measures include adjustments to exclude items that may cause short‐term fluctuations in the nearest GAAP measure, but which management does not consider to be the fundamental attributes or primary drivers of the Company’s business. The Company believes that exclusion of these items assists in providing a more complete understanding of the Company’s underlying results from continuing operations and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its consolidated and business segment performance compared to prior periods and the marketplace, to establish operational goals and management incentive goals, and to provide continuity to investors for comparability purposes. Limitations associated with the use of these non‐GAAP measures include that these measures do not present all the amounts associated with the Company’s results as determined in accordance with GAAP. These non‐GAAP measures should be considered supplemental in nature and should not be construed as more significant than comparable measures defined by GAAP. Because not all companies use identical calculations, these presentations may not be comparable to other similarly titled measures of other companies. For more information regarding the use of these non‐GAAP financial measures, please refer to the reconciliations on the following pages and the Company’s SEC filings. Constant Currency Information In this presentation the Company refers to, and in other communications with investors the Company may refer to, net sales or earnings or other historical financial information on a “constant currency basis,” which is a non‐GAAP financial measure. These references to constant currency basis do not include operational impacts that could result from fluctuations in foreign currency rates. To provide information on a constant currency basis, the applicable financial results are adjusted based on a simple mathematical model that translates current period results in local currency using the comparable prior corresponding period’s currency conversion rate. This approach is used for countries where the functional currency is the local country currency. This information is provided so that certain financial results can be viewed without the impact of fluctuations in foreign currency rates, thereby facilitating period‐to‐period comparisons of business performance. EBITDA and Adjusted EBITDA A reconciliation of the Company’s GAAP net income to EBITDA and adjusted EBITDA per credit facility (which we refer to in this investor presentation as adjusted EBITDA) is provided on the subsequent slides. Management believes that the use of EBITDA and adjusted EBITDA per credit facility provides investors with useful information with respect to the Company’s operating performance and comparisons from period to period as well as the Company’s compliance with requirements under its credit agreement. Adjusted Net Income and Adjusted EPS A reconciliation of the Company’s GAAP net income to adjusted net income and a calculation of adjusted EPS are provided on subsequent slides. Management believes that the use of adjusted net income and adjusted EPS also provides investors with useful information with respect to the Company’s operating performance and comparisons from period to period. Forward‐looking Adjusted EPS is a non‐GAAP financial measure. The Company is unable to reconcile this forward‐looking non‐GAAP measure to EPS, its most directly comparable forward‐looking GAAP financial measure, without unreasonable efforts, because the Company is currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact EPS in 2022. Leverage Consolidated indebtedness less netted cash to adjusted EBITDA per credit facility, which the Company may refer to as leverage, is provided on a subsequent slide and is calculated by dividing consolidated indebtedness less netted cash, as defined by the Company’s senior secured credit facility, by adjusted EBITDA per credit facility. The Company provides this as supplemental information to investors regarding the Company’s operating performance and comparisons from period to period, as well as general information about the Company's progress in reducing its leverage. Use of Non-GAAP Financial Measures and Constant Currency Information 39

40 QTD Adjusted Net Income(2) and Adjusted EPS(2) *For a reconciliation net income to adjusted net income and adjusted EPS in prior reporting periods, please refer to the Company’s SEC filings.

41 TTM Adjusted Net Income(2) and Adjusted EPS(2) *For a reconciliation net income to adjusted net income and adjusted EPS in prior reporting periods, please refer to the Company’s SEC filings.

42 QTD EBITDA(2) *For a reconciliation net income to EBITDA and Adjusted EBITDA in prior reporting periods, please refer to the Company’s SEC filings.

43 TTM Adjusted EBITDA(2) *For a reconciliation net income to EBITDA and Adjusted EBITDA in prior reporting periods, please refer to the Company’s SEC filings.

44 Leverage(2) Reconciliation *For a reconciliation of leverage to consolidated indebtedness less netted cash in prior reporting periods, please refer to the Company’s SEC filings.

© 2022 Tempur Sealy International, Inc. All rights reserved. 1 Management estimates 2 Adjusted net income, EBITDA, adjusted EBITDA, adjusted EPS, leverage and constant currency are non‐GAAP financial measures. Please refer to the “Use of Non‐GAAP Financial Measures and Constant Currency Information” on a previous slide for more information regarding the definitions of adjusted net income, EBITDA, adjusted EBITDA, adjusted EPS, leverage, free cash flow, and constant currency, including the adjustments (as applicable) from the corresponding GAAP information. Please refer to “Forward‐Looking Statements” and “Limitations on Guidance” on a previous slide. 3 Sealy® was ranked number one on Furniture Today’s list of the Top 20 U.S. Bedding Producers in June 2021. See Furniture Today’s Top 20 U.S. Bedding Producers methodology that includes Sealy® and Stearns & Foster® products in Sealy ranking. Tempur‐Pedic® was ranked number two on Furniture Today’s list of the Top 20 U.S. Bedding Producers in June 2021. 4 Based on the Company’s 2022 financial targets provided in the press release dated July 27, 2022, and the related earnings call on July 27, 2022. Please refer to “Forward‐Looking Statements” and “Limitations on Guidance.” Footnotes

Thank You 46